Proposing the police to intervene to reduce tax debt for transport businesses

(Baonghean.vn) - The total tax debt and bad debt in Quynh Luu district tends to increase. Tax debt in the transport business sector is mainly in individual businesses, so the locality has requested the police to intervene.

|

| Comrade Hoang Viet Duong - Member of the Provincial Party Executive Committee, Vice Chairman of the Provincial People's Council chaired the meeting. Photo: Minh Chi |

Losses and difficulties in collecting in the transport business sector

On the afternoon of April 26, the Provincial People's Council had a working session with the Tax Department of Quynh Luu district according to the program of monitoring budget collection in the province in the 3 years 2016 - 2018.

Through the meeting, the monitoring delegation noted that the annual budget collection in the district has seen a high growth. Specifically, in 2016, the total revenue in the district was 218.8 billion VND, an increase of 33% over the same period; in 2017, the total revenue was 253.1 billion VND, an increase of 14% over the same period; in 2018, the total revenue was 381.3 billion VND, an increase of 52% over the same period.

Although revenue collection has increased, the revenue structure is not reasonable and does not ensure sustainability; mainly from land use fees; while taxes on non-state industry, commerce and services are decreasing, while the local economic growth rate is still at 9-10%.

|

| One-stop shop for handling tax administrative procedures at Quynh Luu Tax Department. Photo: Minh Chi |

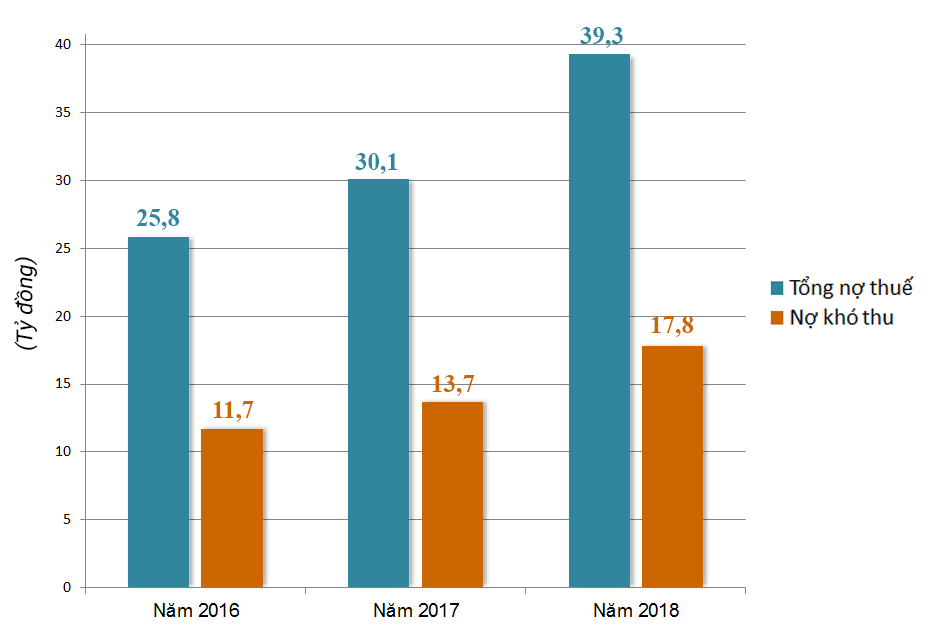

On the other hand, every year, the Tax sector has taken many measures to urge and collect tax debts, reaching 97-100% of the allocated expenditure, but the total tax debt and bad debt arising every year still increases. It is worth noting that the allowable tax debt target directed by the General Department of Taxation is not to exceed 5% of the total budget revenue in the area, but in reality, the tax rate in the district is still more than 10%.

Particularly for individual business households, total tax debt and bad debt mainly fall on transport business households. For example, in Cau Giat town, the total tax debt in the area is 718 million VND (as of December 31, 2018), of which bad debt is more than 426 million VND, of which debt in the transport business sector is 345 million VND.

|

| Total tax debt in Quynh Luu district is increasing. |

|

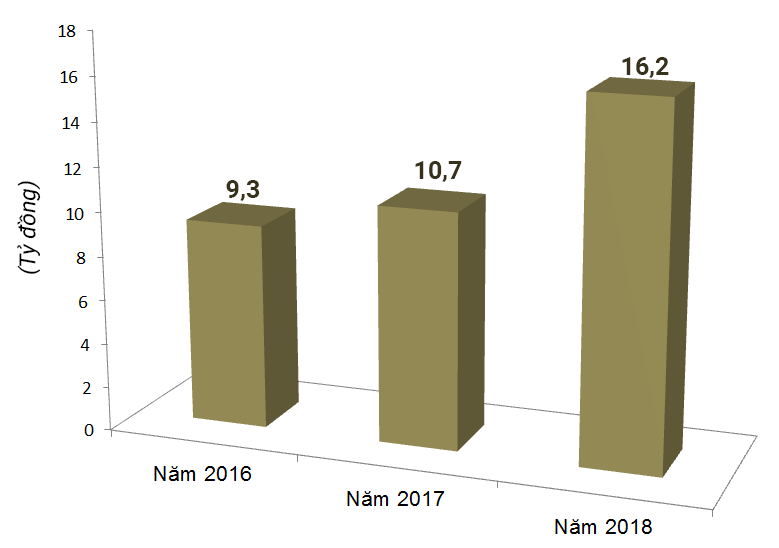

| Tax debt collection results in 3 years 2016 - 2018 in Quynh Luu district. Graphics: Huu Quan |

There needs to be a solution to gradually reduce annual tax debt.

From this reality, the Quynh Luu District Tax Department and the Cau Giat Town government recommend that the police should check tax compliance during administrative inspections to handle tax evasion cases; or through inspection centers to monitor and force vehicle owners to fulfill their transport business tax obligations before conducting inspections.

At the meeting, members of the monitoring delegation raised many issues related to the shortfall in revenue from industrial and commercial taxes, non-state services, fees and charges. The review and establishment of tax sets for individual business households has ensured the correct and sufficient subjects; measures to handle cases of failure to declare and pay taxes, including non-agricultural land tax; post-declaration audit work of enterprises and individual business households...

|

| Head of the Quynh Luu District Tax Department Nguyen Van Thang explains why tax debt in the area has increased. Photo: Minh Chi |

Concluding the meeting, Vice Chairman of the Provincial People's Council Hoang Viet Duong requested the Party Committee and authorities to strengthen leadership and direction of budget collection in the area, ensure the completion of budget collection targets, and ensure revenue balance.

Emphasizing that with the current mechanism of self-calculation, self-declaration and self-payment of taxes from taxpayers, tax evasion and tax losses are likely to arise, the Vice Chairman of the Provincial People's Council requested the Tax Department to focus on tax inspection and examination, ensuring correct and full collection, ensuring fairness and transparency among taxpayers.

|

| Vice Chairman of the Provincial People's Council Hoang Viet Duong requested the Tax Department of Quynh Luu district to pay attention to the work of receiving people and resolving tax-related petitions. |

Along with that is propaganda and guidance for businesses on accounting practices, ensuring compliance with financial laws, creating conditions for businesses to develop and nurture revenue sources for the locality, and preventing tax losses.

Authorities at all levels and tax agencies should join in urging the collection of tax arrears, striving to gradually reduce tax arrears every year; at the same time, make recommendations to competent authorities to handle difficult-to-collect arrears. Tax departments should also pay attention to receiving people, having dialogue with people, and properly handling tax-related petitions.

.png)

.jpg)

.jpg)