Finance sector exceeds budget revenue by more than 79 trillion VND

(Baonghean.vn) - On the afternoon of January 6, under the chairmanship of Minister of Finance Dinh Tien Dung, the Ministry of Finance held an online conference with 63 provinces and cities to summarize the work in 2016 and deploy the plan for 2017 of the Finance sector.

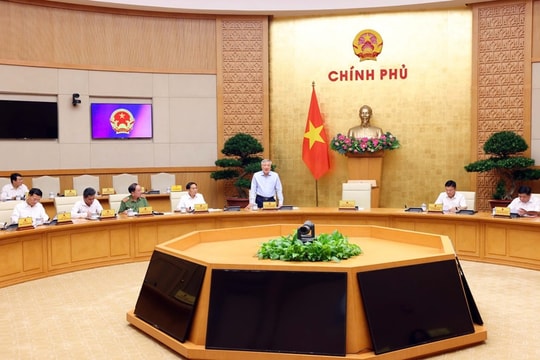

Attending the event were Prime Minister Nguyen Xuan Phuc, Deputy Prime Minister Vuong Dinh Hue, and representatives of central ministries, departments, and branches. At Nghe An bridge, comrade Le Xuan Dai, member of the Provincial Party Standing Committee - Permanent Vice Chairman of the Provincial People's Committee chaired.

|

| View of the online conference at Nghe An bridge. |

In 2016, the Ministry of Finance proactively coordinated closely with ministries, branches, Party committees and local authorities to effectively direct and manage state budget collection from the beginning of the year. Directed the Tax and Customs agencies to proactively and resolutely implement solutions to manage collection, prevent revenue loss, transfer pricing, smuggling, trade fraud, tax evasion; enforce tax debt collection, and strengthen tax inspection and examination of enterprises.

During the year, the Tax Department inspected and examined nearly 82,000 enterprises, thereby increasing revenue by 14.5 trillion VND (9.2 trillion VND was collected into the budget); urged and enforced the collection of 42 trillion VND of tax arrears transferred from 2015; and collected 6.6 trillion VND of the amounts recommended by the State Audit in the 2014 State budget settlement.

|

| Comrade Le Xuan Dai, Permanent Vice Chairman of the Provincial People's Committee chaired at Nghe An bridge point. |

The Customs Department has conducted nearly 9,300 post-clearance inspections, thereby increasing revenue for the budget by 3,300 billion VND; and has collected and handled 499 billion VND of tax arrears from declarations arising before December 31, 2015.

By December 31, 2016, the State budget revenue balance was estimated at about 1,094 trillion VND, exceeding 79.6 trillion VND (+7.8%) compared to the estimate, increasing by 55 trillion VND compared to the report to the National Assembly. Of which, local budget revenue reached 118.6% of the estimate (equivalent to exceeding 77.8 trillion VND), most localities achieved and exceeded the assigned estimate (58/63 localities); central budget revenue excluding recorded revenue and expenditure of aid for projects, basically met the estimate.

Based on the socio-economic development plan and the State budget estimate approved by the National Assembly, the Ministry of Finance determined the specific financial and State budget tasks for 2017: Regarding State budget revenue, the Government submitted to the National Assembly for approval the State budget revenue estimate for 2017 of 1,212.18 trillion VND; Regarding State budget expenditure, the State budget expenditure estimate for 2017 is 1,390.48 trillion VND.

|

| Nghe An Tax Department has implemented an initiative to seal lead at gas stations, effectively preventing tax losses in the business of this product. |

Speaking at the conference, Prime Minister Nguyen Xuan Phuc praised the entire Finance sector and appreciated the efforts of localities in collecting state budget revenue and controlling deficit, which have contributed to the success in the country's socio-economic development. The Prime Minister requested the Finance sector and localities to continue implementing tight fiscal policies, synchronously coordinating with monetary policies to support production and business development; contributing to stabilizing the macro-economy and controlling inflation according to the set targets.

Promote administrative procedure reform in the financial sector, focusing on Tax, Customs, etc. Resolutely implement the work of collecting the State budget, determined to achieve and exceed the estimate. Organize the management and expenditure of the State budget strictly, economically, in accordance with regulations, and against waste. Proactively integrate into international finance and innovate the method of State budget management.

To successfully complete the financial and state budget tasks in 2017, the Prime Minister requested ministries, branches and localities to focus on directing the effective implementation of solutions for economic and social development and the 2017 state budget estimate according to the resolutions of the National Assembly and the Government. Proactively implement from the first quarter, tighten tax debt collection, and review tax incentive policies, rectify over-collection affecting the business community and people. It is necessary to ensure reasonable social security policies, avoid leveling. In the immediate future, focus on directing and operating to ensure production and business activities during the Lunar New Year 2017./.

Quynh Lan

.jpg)

.jpg)