Nghe An: More than 46,000 poor households and policy beneficiaries receive preferential loans

(Baonghean.vn) - In the first six months of 2022, policy credit capital in Nghe An has provided preferential credit capital to 46,418 poor households and other policy beneficiaries. Social policy credit continues to make important contributions to the socio-economic development achievements of the province.

On the morning of August 17, the Board of Directors of the Provincial Social Policy Bank held its 72nd regular meeting to deploy tasks for the third quarter of 2022. Attending were members of the Board of Directors of the Social Policy Bank. Comrade Nguyen Thi Thu Thu - Director of the State Bank of Nghe An branch, member of the Board of Directors, chaired the meeting.

|

Members attending the meeting. Photo: Thu Huyen |

Increase disbursement and support for policy subjects

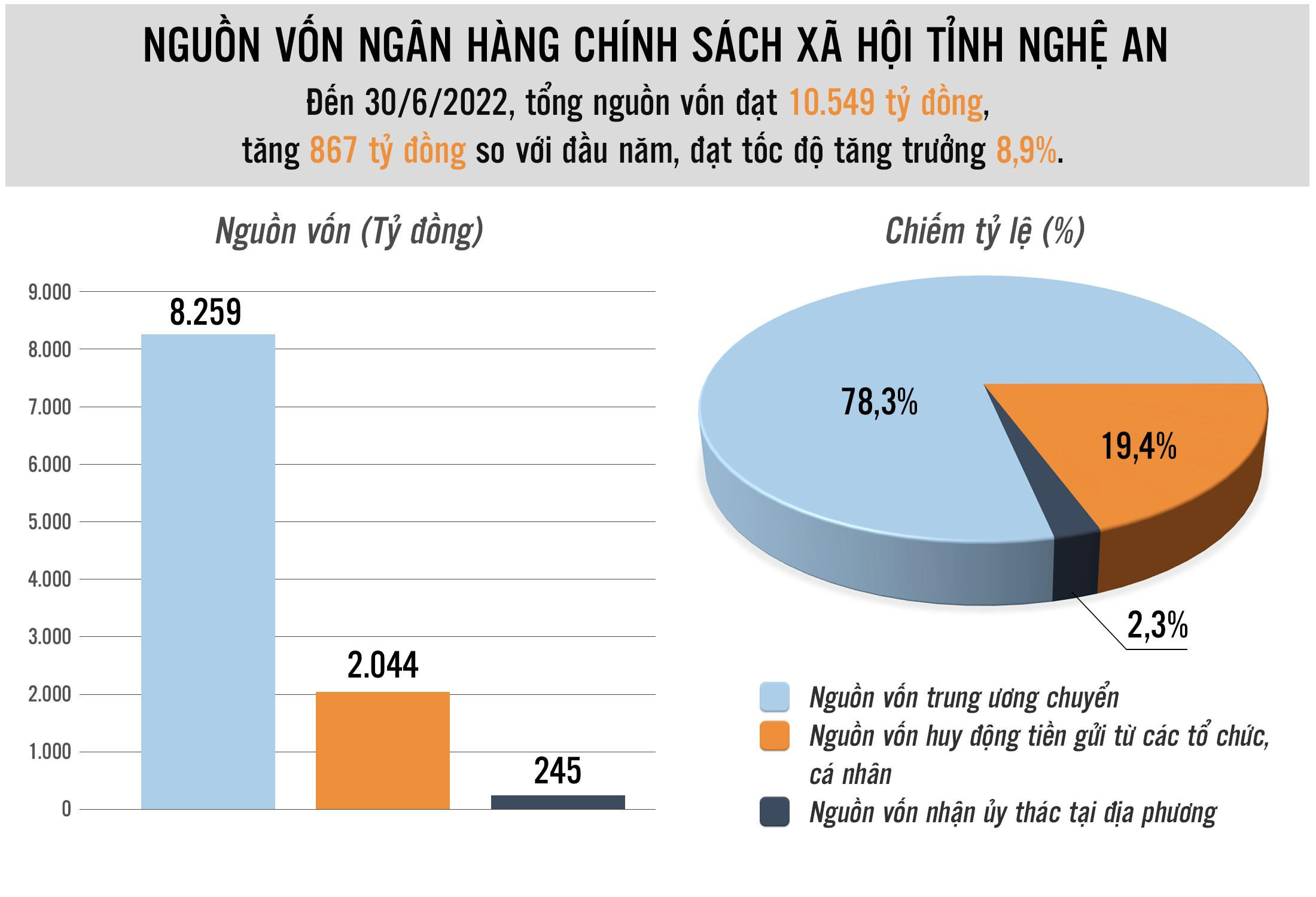

By June 30, 2022, totalpolicy fundingin the province reached 10,549 billion VND, achieving a growth rate of 8.9%. Loan turnover in the first 6 months of the year reached 1,956 billion VND, up 2.68% over the same period last year. Of which: 15/22 programs were disbursed; 07 programs were not disbursed, the reason was that these programs had expired. Especially in the first 6 months of the year, the unit was very activedisbursement of capitalof 04 programs under the socio-economic recovery and development support package according to Resolution No. 11 of the Government.

By June 30, 2022, the total outstanding debt reached nearly VND 10,522 billion/22 policy credit programs, achieving a growth rate of 8.8%.

|

Director of the Provincial Social Policy Bank Tran Khac Hung reports on the first 6 months' performance of the Board of Directors of the Social Policy Bank. Photo: Thu Huyen |

The branch continues to disburse capital to support businesses in the area whose workers have lost their jobs due to the impact of the Covid-19 pandemic, ensuring timeliness before the program ends on March 31, 2022. At the end of the program, the whole province has 56 businesses/amount of nearly 22 billion VND/3,128 workers supported. Continue to restructure debt repayment terms (debt extension, debt repayment term adjustment) for 2,310 customers with a loan amount of more than 53 billion VND. Provide additional loans to invest in restoring and expanding production for 716 customers with an amount of nearly 31 billion VND.

|

Graphics: Huu Quan |

Results of implementing preferential credit policies according to Resolution No. 11 of the Government: From April 27, 2022 to June 30, 2022, the Branch disbursed capital of 04/5 programs to 8,913 customers, amounting to VND 250.2 billion, completing 78.4%.

In the first six months of 2022, policy credit capital has provided preferential credit capital to 46,418 poor households and other policy beneficiaries. Social policy credit continues to make important contributions to the socio-economic development of the province. With the achievements in the first six months of the year, Nghe An Branch has been classified by the Emulation and Commendation Council of the Social Policy Bank as having completed its tasks excellently (one of the 10 best branches in the system in the first six months of 2022).

|

Representative of the Provincial Ethnic Committee spoke at the meeting. Photo: Thu Huyen |

Continue to closely monitor capital sources

The meeting also gave opinions on the plan to summarize 20 years of implementation.preferential credit policyfor poor households and other policy beneficiaries according to Decree 78/2002/ND-CP dated October 4, 2002 of the Government. In addition to recognizing the achievements, the members of the representative board had many opinions on the current difficulties and shortcomings. That is, although the demand for loans for the employment creation program in the province is very large (730 billion VND in 2022), the central budget capital source still has many difficulties and limitations. Up to now, the Central Bank for Social Policies has only provided 155 billion VND (of which the capital provided to implement Resolution 11 is 130 billion VND) and the local budget counterpart capital is 25 billion VND.

Although the local budget capital has exceeded the assigned target, compared to the whole system, Nghe An is still very low; Cua Lo town alone has not completed the assigned target (the town People's Committee has only allocated 200 million VND/target assigned by the Provincial People's Committee of 600 million VND, completing 33.3%).

|

| Comrade Do Thi Thu Thao - Vice President of the Women's Union, Member of the Board of Directors of the Vietnam Bank for Social Policies visited the policy loan production model during the supervision and working session in Nam Dan district in early August 2022. Photo: Thu Huyen |

For the programlending to ethnic minority and mountainous areas: The process of coordinating review and determining capital needs encountered many difficulties. Completing the disbursement plan of 150 billion VND of capital for this program in 2022 is truly a challenge for the unit.

Concluding the meeting, Comrade Nguyen Thi Thu Thu - Director of the State Bank acknowledged the efforts and achievements of the Representative Board of the Social Policy Bank. Regarding the tasks for the coming time, she requested the Representative Board of the Board of Directors at the provincial and district levels; the Social Policy Bank at the provincial and district levels to advise on the effective implementation of Conclusion No. 06-KL/TW and Directive No. 40-CT/TW of the Secretariat on strengthening the Party's leadership over policy credit in the province. Advise the Provincial People's Committee to organize a summary of 20 years of implementing Decree No. 78/2002/ND-CP dated October 4, 2002 in September 2022.

|

Comrade Nguyen Thi Thu Thu - Director of the State Bank, member of the Board of Directors of the Provincial Social Policy Bank concluded the meeting. Photo: Thu Huyen |

Direct the district-level representative board to effectively implement preferential credit policies in the area, especially the Chairman of the People's Committee at the commune level needs to regularly and closely monitor capital sources to ensurelending to the right people, using capital for the right purposes, promote efficiency; inspect and supervise the implementation of preferential credit lending programs according to Resolution No. 11 and the 2% interest rate support package, avoiding policy exploitation.

The entrusted socio-political organizations focus on directing the grassroots units to fully and effectively carry out the entrusted work contents according to the agreement and the entrustment contract: Regularly propagate and mobilize members and union members to properly implement the Group's operating regulations, actively participate in saving, and share production and business knowledge; direct the Savings and Loan Group to seriously carry out the loan evaluation work to ensure publicity, democracy, and the right subjects; strengthen inspection and supervision work to promptly detect problems, prevent violations, and take advantage of policies.

.jpg)

.jpg)