Policy capital in Nghe An grows strongly

(Baonghean.vn) - Standing Vice Chairman of the Provincial People's Committee Le Hong Vinh suggested that it is necessary to continue to have solutions to mobilize capital sources; at the same time, inspect and supervise the implementation of preferential credit programs according to Resolution No. 11 and the 2% interest rate support package, to avoid taking advantage of policies.

On the morning of October 20, the Board of Directors of the Provincial Social Policy Bank held its 73rd regular meeting. Comrade Le Hong Vinh - Member of the Provincial Party Standing Committee, Permanent Vice Chairman of the Provincial People's Committee, Head of the Board of Directors chaired the meeting. Attending were members of the Board of Directors and socio-political organizations.

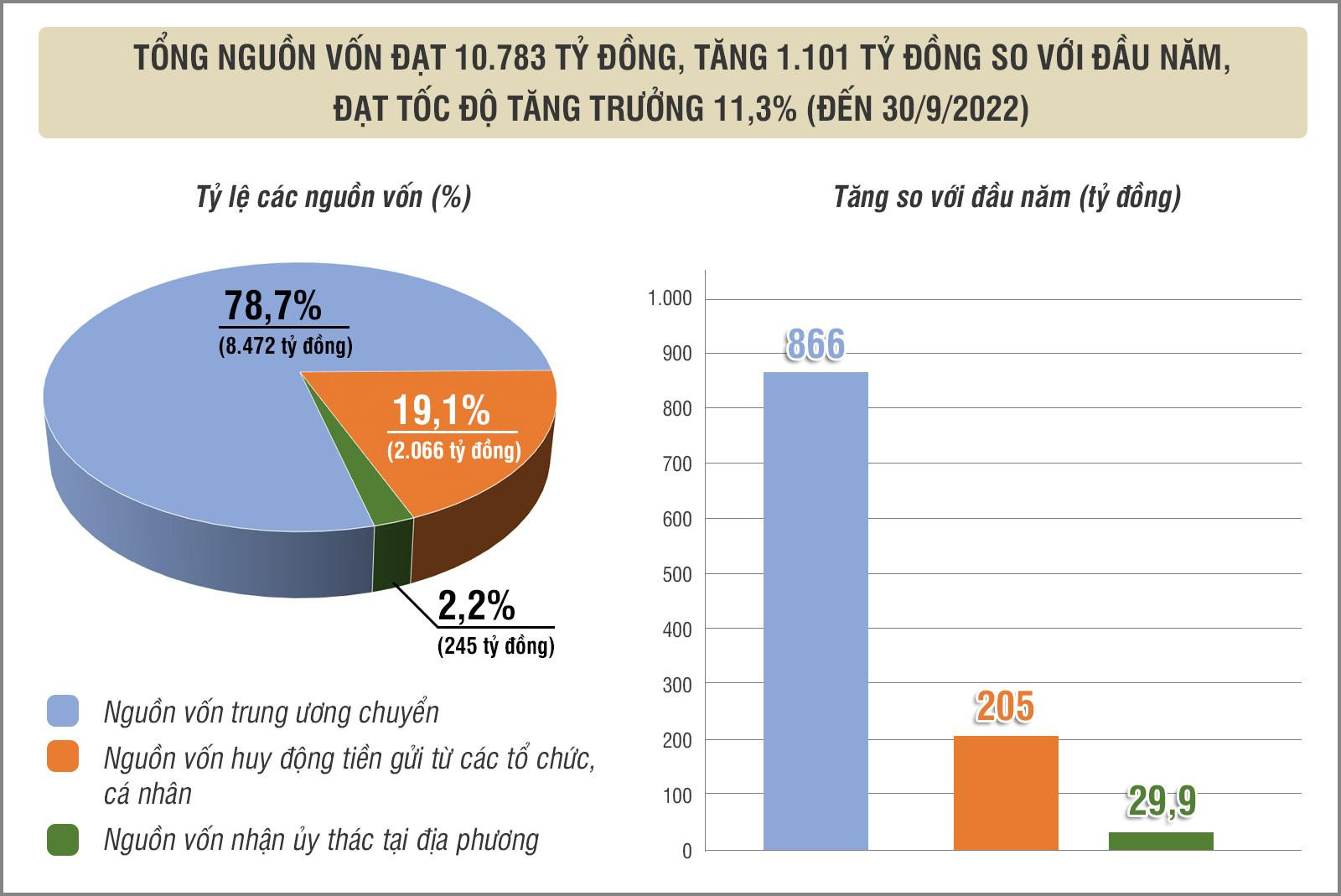

Capital growth reached 11.3%

|

Overview of the meeting of the Board of Directors of the Provincial Social Policy Bank on the morning of October 20. Photo: Thu Huyen |

In the first 9 months of the year, closely following the Resolution of the Board of Directors and the regular Resolution of the Board, the Board of Directors' representatives at the provincial and district levels directed the Social Policy Bank Branches and the entrusted socio-political organizations to well implement the key tasks.

By September 30, 2022, total capital increased by 3.7% over the same period last year and completed the capital growth target for 2022 according to the Resolution of the Provincial Board of Directors.

|

Graphics: Huu Quan |

Loan turnover in the first 9 months of the year reached VND 2,435 billion, of which 15/22 programs are being disbursed. The unit has actively disbursed capital for programs under the socio-economic recovery and development support package according to Resolution No. 11/NQ-CP dated November 30, 2022 of the Government. Capital for 5 policy credit programs implemented according to Resolution No. 11 of the Government on lending for economic recovery and development reached VND 481.5 billion.

There are 7 programs that do not generate loans, which are programs that have expired. Most customers comply with the regulations on debt repayment and interest payment when due according to the agreement.

By September 30, 2022, the total outstanding debt reached nearly VND 10,538 billion/22 policy credit programs, an increase of VND 868 billion compared to the beginning of the year, achieving a growth rate of 8.97%. Loan turnover for credit programs through entrustment in the first 9 months of the year reached VND 2,386 billion; debt collection turnover reached VND 1,533 billion. Entrusted credit outstanding debt reached VND 10,462 billion, accounting for 99.28% of total outstanding debt; all 4 organizations receiving entrustment had outstanding debt increased compared to the beginning of the year.

|

Director of the State Bank of Vietnam, Nghe An branch, Nguyen Thi Thu Thu, highly appreciated the capital growth target for 2022 of the provincial Social Policy Bank. Photo: Thu Huyen |

In the first 9 months of 2022, policy credit capital has provided preferential capital to 58,361 poor households and other policy beneficiaries. Social policy credit continues to make an important contribution to completing the goals of poverty reduction, ensuring social security and building new rural areas of the province in 2022.

However, the circulation of storm No. 4 caused heavy rain, flooding, flash floods, landslides in the districts, causing heavy damage to people and property, making life difficult for people in the disaster-affected areas, affecting debt collection, interest collection and transaction activities in communes in the districts affected by the disaster. The disbursement of 150 billion VND under Resolution 28 is slow, and solutions are needed to speed up...

|

Deputy Director of the Department of Planning and Investment Nguyen Van Truong spoke at the meeting. Photo: Thu Huyen |

Focus on allocating budget trust funds for 2023

Speaking at the conference, Standing Vice Chairman of the Provincial People's Committee Le Hong Vinh acknowledged the results achieved in the first 9 months of the year. Especially in the third quarter, the whole province successfully organized a conference to summarize 20 years of implementing Decree No. 78 of the Government on credit for the poor and other policy beneficiaries from district to provincial levels.

Regarding tasks and solutions from now until the end of the year, the Standing Vice Chairman of the Provincial People's Committee requested members of the Department of Finance and the Provincial Social Policy Bank to advise the Provincial People's Committee on allocating budget trust funds for 2023 and directing the District People's Committees to implement the assigned local budget trust fund targets.

|

Comrade Le Hong Vinh - Permanent Vice Chairman of the Provincial People's Committee delivered a concluding speech at the meeting. Photo: Thu Huyen |

Regarding the capital source of 150 billion VND according to Decree No. 28/2022/ND-CP dated April 26, 2022 of the Government, the Head of the Board of Directors of the Provincial Social Policy Bank requested the Provincial Ethnic Committee to advise the Provincial People's Committee to direct the People's Committees of districts to promptly review and approve the list of beneficiaries of policy credit as a basis for disbursing capital, promptly supporting capital needs for production and stabilizing the lives of policy beneficiaries.

Comrade Le Hong Vinh also requested to promptly notify the allocation of additional capital in 2022 to districts, cities and towns (190 billion VND) to quickly disburse capital for programs, striving to complete the disbursement work before November 30, 2022.

The district-level representative board needs to organize and implement well the preferential credit policies in the area. In particular, the member of the district-level representative board who is the Chairman of the People's Committee at the commune level needs to fully perform his role and responsibility in implementing, managing and supervising the policy credit capital in the area, ensuring loans to the right subjects, using capital for the right purposes, promoting efficiency; inspecting and supervising the implementation of lending to preferential credit programs according to Resolution No. 11 and the 2% interest rate support package, avoiding policy exploitation.

The Social Policy Bank at the provincial and district levels continues to coordinate with relevant agencies, units and organizations to advise local Party committees and authorities to effectively implement policy credit programs; Focus on advising to increase capital sources entrusted from local budgets to complete the goal of rapid and sustainable poverty reduction and ensure social security in the area.

|

| Thanks to loans from the Policy Bank, some households in Nam Dan district have more favorable conditions to develop their economy. Photo: Thu Huyen |

The entrusted socio-political organizations continue to do a good job of propaganda and mobilizing people to actively participate in depositing savings into the Provincial Social Policy Bank. Guide borrowers to complete their application documents in accordance with regulations; avoid overlapping lending programs, loans exceeding the limit, households with many people borrowing money...