Gold price today August 15: Domestic gold price falls from record peak, world price slightly decreases profit taking

Gold price today August 15, 2025: Domestic gold price falls from record peak of nearly 125 million VND/tael. World gold price slightly decreased to take profit after increasing for 3 consecutive days

Gold pricedomestic today 8/15/2025

As of 4:00 a.m. today, August 15, 2025, the domestic gold bar price increased compared to yesterday. Specifically:

DOJI Group listed the price of SJC gold bars at 123.5-124.7 million VND/tael (buy - sell), an increase of 800 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 123.7-124.7 million VND/tael (buy - sell), an increase of 700 thousand VND/tael in buying - an increase of 500 thousand VND/tael in selling compared to the closing price on August 13 yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 124-124.7 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 600 thousand VND/tael for buying and 500 thousand VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by the enterprise at 123.7-124.7 million VND/tael (buy - sell), the price increased by 700 thousand VND/tael in buying direction - increased by 500 thousand VND/tael in selling direction compared to the same period yesterday.

SJC gold price at Phu Quy is traded by businesses at 122.7-124.7 million VND/tael (buy - sell), gold price increased 500 thousand VND/tael in both buying and selling directions compared to yesterday.

As of 4:00 a.m. on August 15, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 116.8-119.8 million VND/tael (buy - sell); the price increased by 300,000 VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 117.5-120.5 million VND/tael (buy - sell); an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, August 15, 2025 is as follows:

| Gold price today | August 15, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 123.7 | 124.7 | +700 | +500 |

| DOJI Group | 123.5 | 124.7 | +800 | +800 |

| Mi Hong | 124 | 124.7 | +600 | +500 |

| PNJ | 123.7 | 124.7 | +700 | +500 |

| Bao Tin Minh Chau | 123.7 | 124.7 | +700 | +500 |

| Phu Quy | 122.7 | 124.7 | +500 | +500 |

| 1.DOJI- Updated: 8/15/2025 4:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 123,500▲800K | 124,700▲800K |

| AVPL/SJC HCM | 123,500▲800K | 124,700▲800K |

| AVPL/SJC DN | 123,500▲800K | 124,700▲800K |

| Raw material 9999 - HN | 109,600▲300K | 110,600▲300K |

| Raw materials 999 - HN | 106,500▲300K | 110,500▲300K |

| 2.PNJ- Updated: 8/15/2025 4:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 123,700▲700K | 124,700▲500K |

| PNJ 999.9 Plain Ring | 116,800 | 119,800▲300K |

| Kim Bao Gold 999.9 | 116,800 | 119,800▲300K |

| Gold Phuc Loc Tai 999.9 | 116,800 | 119,800▲300K |

| PNJ Gold - Phoenix | 116,800 | 119,800▲300K |

| 999.9 gold jewelry | 116,100 | 118,600 |

| 999 gold jewelry | 115,980 | 118,480 |

| 9920 gold jewelry | 115,250 | 117,750 |

| 99 gold jewelry | 115,010 | 117,510 |

| 916 Gold (22K) | 106,240 | 108,740 |

| 750 Gold (18K) | 81,600 | 89,100 |

| 680 Gold (16.3K) | 73,300 | 80,800 |

| 650 Gold (15.6K) | 69,740 | 77,240 |

| 610 Gold (14.6K) | 65,000 | 72,500 |

| 585 Gold (14K) | 62,030 | 69,530 |

| 416 Gold (10K) | 41,990 | 49,490 |

| 375 Gold (9K) | 37,130 | 44,630 |

| 333 Gold (8K) | 31,790 | 39,290 |

| 3.SJC- Updated: 8/15/2025 4:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 123,700▲700K | 124,700▲500K |

| SJC gold 5 chi | 123,700▲700K | 124,720▲500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 123,700▲700K | 124,730▲500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 116,800 | 119,400 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 116,800 | 119,300 |

| 99.99% jewelry | 116,600 | 118,400▼200K |

| 99% Jewelry | 112,727▼198K | 117,227▼198K |

| Jewelry 68% | 73,470▼136K | 80,670▼136K |

| Jewelry 41.7% | 42,327▼83K | 49,527▼83K |

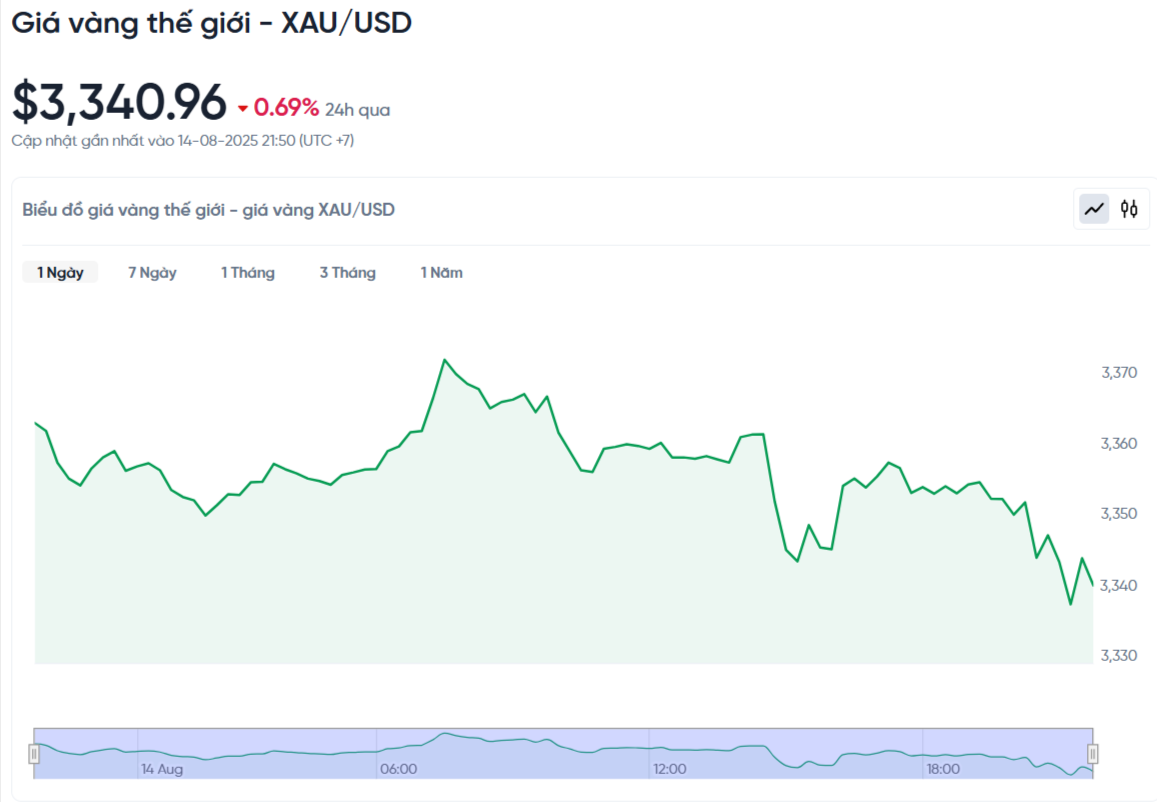

World gold price today August 15, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:00 a.m. on August 15, Vietnam time, was 3,340.96 USD/ounce. Today's gold price decreased by 23.06 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,440 VND/USD), the world gold price is about 106.66 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 18.04 million VND/tael higher than the international gold price.

World gold prices fell slightly after the US PPI inflation data in July increased more than expected, along with the first unemployment data last week, pushing the USD and Treasury bond yields up. This reduced expectations that the Federal Reserve (Fed) will cut interest rates sharply in September.

Specifically, spot gold prices fell 0.69%. US gold futures for December delivery also fell 0.2% to $3,400.60.

The dollar rose 0.2% from its lowest in more than two weeks, making gold more expensive for buyers outside the U.S. Meanwhile, the yield on the benchmark 10-year Treasury note also rose slightly from its lowest level in a week.

The US Department of Labor said the PPI rose 0.9% in July, after remaining flat in June. This was much higher than the forecast of a 0.2% increase. Compared to the same period last year, the PPI increased 3.3%, the highest increase since February 2025.

These data have led the market to reduce expectations for a sharp 0.5-point rate cut in September. Instead, the Fed is likely to cut only 0.25 points and continue a similar cut in October. This is in line with the opinion of Mary Daly, a Fed official, that such a sharp cut is not necessary.

"Gold prices fell as stronger-than-expected PPI data could dampen hopes of a rate cut. This also led to a rise in core PCE inflation in July, prompting the Fed to be more cautious. However, we remain bullish on gold as the Fed will ultimately have to choose between containing inflation or supporting the economy," said Ole Hansen, commodity strategist at Saxo Bank.

Mohammed Taha, market analyst at MH Markets, said: "PPI data shows that inflationary pressures remain, which could weigh on gold prices as investors worry that interest rates will remain high for longer. However, if the Fed is forced to ease policy due to economic weakness or persistent inflation, gold prices could recover and head towards $3,450-$3,500."

Gold prices continued to fall in the session after the US released better-than-expected labor market data. The number of people filing for unemployment benefits for the first time last week was lower than economists forecast. The number of new claims for unemployment benefits, a seasonally adjusted 224,000 for the week ended August 9, was lower than the forecast of 228,000, according to the US Labor Department. The previous week's figure was revised up slightly from 227,000.

Besides gold, spot silver fell 1% to $38.11 an ounce. Meanwhile, platinum rose 1% to $1,352.60 and palladium rose 1.7% to $1,140.81.

Gold price forecast

Currently, the world gold price is under some profit-taking selling pressure as the US gradually reaches trade agreements with many countries. However, the overall picture still has many unstable factors that make investors cautious. The conflict in Ukraine continues to pose many risks, especially after the White House on August 12 expressed little hope about the possibility of reaching a ceasefire agreement between US President Donald Trump and his Russian counterpart Putin.

One of the main drivers pushing gold prices higher recently is the expectation that the US Federal Reserve (Fed) will aggressively cut interest rates after Mr. Trump's statements. Although facing profit-taking pressure in the short term, gold still benefits from many geopolitical uncertainties along with the trend of the USD possibly falling in the medium and long term.

Professor Thorsten Polleit, an economist at the University of Bayreuth and editor of the BOOM & BUST REPORT, shared his views in a recent interview. He said that it is understandable that bond yields remain high as investors demand a higher risk premium. However, he does not expect the US 10-year bond yield to exceed 5%.

According to Professor Polleit, the Fed is probably hoping that cutting short-term interest rates will help to reduce long-term interest rates. 'If this measure does not work, it is very likely that central banks will have to intervene and buy again, and as yields fall, gold prices will continue to rise. The gold market has a lot of potential and momentum, I expect prices to be higher before the end of the year.'

In the long term, the professor is very optimistic, saying that the possibility of gold prices doubling in the next 5 to 10 years is not excluded. This assessment is based on many fundamental factors including the need to diversify global reserves, the context of prolonged low interest rates and persistent economic and political instability.

Gold prices are currently finding strong support above $3,300 an ounce. According to ING analysis, it is only a matter of time before gold prices break out of their current sideways phase and retest record highs.

In her latest monthly report, Ewa Manthey, commodity strategist at ING, revised up her forecast for gold prices due to signs of weakness in the US labor market and persistent inflationary pressures. She now expects gold prices to average $3,400 an ounce in the third quarter and $3,450 in the fourth quarter, significantly higher than her previous forecast of $3,200 for both quarters.

Ms. Manthey expects gold prices to surpass $3,500 in the first quarter of 2025, 9% higher than the previous estimate. In 2026, the average price is expected to reach $3,512 an ounce, up sharply from $3,175 in the previous forecast. This upward revision comes from expectations that the Fed will cut interest rates aggressively in the second half of 2025.

"With rising expectations of US rate cuts, gold could be poised to set a new record high. Our economics team predicts three cuts this year and two more by early 2026, which is stronger than the general market expectation," said Ms. Manthey.