Latest gold price September 4: Domestic has new peak, world decreases

Gold price update September 4: Domestic gold price continues to rise, challenging new peak. World gold price slightly decreased to take profit after reaching an all-time high.

Domestic gold price today September 4, 2025

As of 10:30 a.m. on September 4, 2025, the domestic gold bar price continued to rise to a new peak. Specifically:

DOJI Group listed the price of SJC gold bars at 132.4 - 133.9 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of gold bars was listed by Saigon Jewelry Company Limited - SJC at 132.4 - 133.9 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in both buying and selling directions compared to the closing price on September 3.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 132.9-133.9 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 500 thousand VND/tael for both buying and selling.

The price of gold bars at Bao Tin Minh Chau Company Limited is traded by the enterprise at 132.4 - 133.9 million VND/tael (buy - sell), the price increased by 1 million VND/tael in the buying direction - increased by 500 thousand VND/tael in the selling direction compared to the same period yesterday.

The price of SJC gold bars at Phu Quy is traded by businesses at 131.5-133.9 million VND/tael (buying - selling), the gold price increased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

As of 10:30 a.m. on September 4, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 126.3-129.3 million VND/tael (buy - sell); an increase of 500,000 VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 126.5-129.5 million VND/tael (buy - sell); an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, September 4, 2025 is as follows:

| Gold price today | September 4, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 132.4 | 133.9 | +500 | +500 |

| DOJI Group | 132.4 | 133.9 | +500 | +500 |

| Mi Hong | 132.9 | 133.9 | +500 | +500 |

| PNJ | 132.4 | 133.9 | +500 | +500 |

| Bao Tin Minh Chau | 132.4 | 133.9 | +500 | +500 |

| Phu Quy | 131.5 | 133.9 | +500 | +500 |

| 1.DOJI- Updated: 9/4/2025 10:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 132,400▲500K | 133,900▲500K |

| AVPL/SJC HCM | 132,400▲500K | 133,900▲500K |

| AVPL/SJC DN | 132,400▲500K | 133,900▲500K |

| Raw material 9999 - HN | 118,500▲500K | 119,500▲500K |

| Raw materials 999 - HN | 118,400▲500K | 119,400▲500K |

| 2.PNJ- Updated: 9/4/2025 10:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 132,400▲500K | 133,900▲500K |

| PNJ 999.9 Plain Ring | 126,300▲500K | 129,300▲500K |

| Kim Bao Gold 999.9 | 126,300▲500K | 129,300▲500K |

| Gold Phuc Loc Tai 999.9 | 126,300▲500K | 129,300▲500K |

| PNJ Gold - Phoenix | 126,300▲500K | 129,300▲500K |

| 999.9 gold jewelry | 125,000▲1100K | 127,500▲1100K |

| 999 gold jewelry | 124,370▲1100K | 126,870▲1100K |

| 9920 gold jewelry | 124,870▲1090K | 127,370▲1090K |

| 99 gold jewelry | 123,830▲1090K | 126,330▲1090K |

| 916 Gold (22K) | 114,390▲1010K | 116,890▲1010K |

| 750 Gold (18K) | 88,280▲830K | 95,780▲830K |

| 680 Gold (16.3K) | 79,350▲750K | 86,850▲750K |

| 650 Gold (15.6K) | 75,530▲720K | 83,030▲720K |

| 610 Gold (14.6K) | 70,430▲680K | 77,930▲680K |

| 585 Gold (14K) | 67,240▲650K | 74,740▲650K |

| 416 Gold (10K) | 45,690▲460K | 53,190▲460K |

| 375 Gold (9K) | 40,460▲410K | 47,960▲410K |

| 333 Gold (8K) | 34,730▲370K | 42,230▲370K |

| 3.SJC- Updated: 9/4/2025 10:30 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 132,400▲500K | 133,900▲500K |

| SJC gold 5 chi | 132,400▲500K | 133,920▲500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 132,400▲500K | 133,930▲500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 126,200▲700K | 128,800▲700K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 126,200▲700K | 128,700▲700K |

| 99.99% jewelry | 124,700▲700K | 127,200▲700K |

| 99% Jewelry | 120,940▲693K | 125,940▲693K |

| Jewelry 68% | 79,154▲476K | 86,654▲476K |

| Jewelry 41.7% | 45,697▲292K | 53,197▲292K |

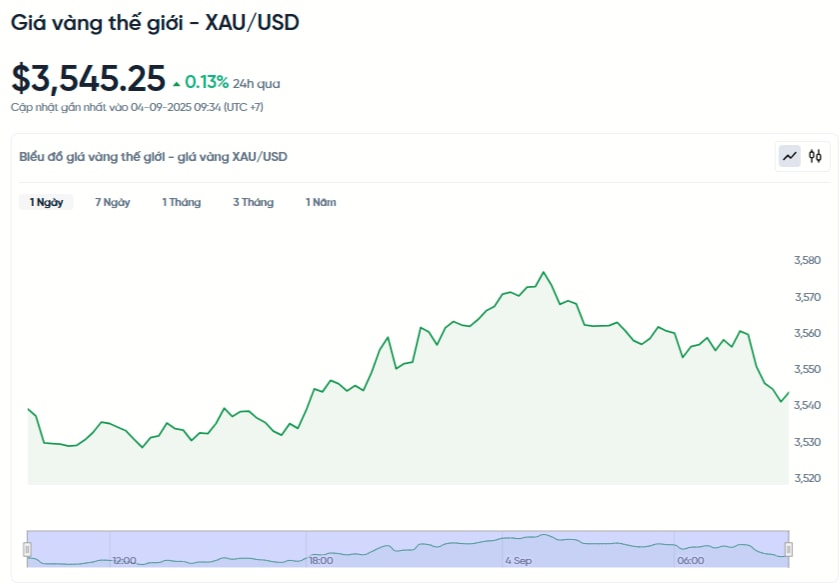

World gold price today September 4, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 10:30 on September 4, Vietnam time, was 3,545.25 USD/ounce. Today's gold price increased by 4.57 USD/ounce compared to yesterday but decreased by nearly 10 USD/ounce compared to the beginning of the day. Converted according to the USD exchange rate at Vietcombank (26,510 VND/USD), the world gold price is about 113.28 million VND/tael (excluding taxes and fees). Thus, the price of gold bars is 20.62 million VND/tael higher than the international gold price.

World gold prices fell slightly in this morning's trading session as investors took profits after gold prices hit a record high the previous day. The reason for the previous increase was due to expectations that the US Federal Reserve (Fed) would cut interest rates. Currently, the market is waiting for the important US employment report to be released this week.

Specifically, spot gold prices fell 0.3%. In the previous session, gold prices set a new record when they reached 3,578.50 USD/Ounce. US gold futures for December delivery also fell 0.8% to 3,605.6 USD/Ounce.

According to Mr. Brian Lan, CEO of GoldSilver Central, today's gold price drop is mainly due to technical profit-taking, and fundamentally, gold is still in a bull market.

Expectations of a Fed rate cut, coupled with concerns about the institution’s independence, will continue to drive demand for safe-haven assets like gold. Mr. Lan even believes that gold prices are likely to rise to $3,800 or higher in the near future. These expectations are reinforced by recent economic data. The US Department of Labor said the number of jobs created in July fell more than expected, to 7.181 million.

Several Fed officials have also expressed the view that concerns about the labor market make them believe that a rate cut is needed soon. Governor Christopher Waller said he thinks the Fed should cut rates at its upcoming meeting.

According to CME Group's FedWatch tool, there is now a 97% chance the Fed will cut interest rates by 0.25% at its two-day policy meeting on September 17. Rate cuts are good for gold because gold does not pay interest and is generally more attractive in a low-interest environment.

The entire market is now focused on the US non-farm payrolls report due on Friday. According to a Reuters poll, the number of jobs created in August is expected to be 78,000, up slightly from 73,000 in July.

Geopolitical factors also contributed to the gold price. President Donald Trump said that the US may have to dismantle the trade agreements signed with the European Union, Japan and South Korea if he loses a lawsuit in the Supreme Court related to tariffs. Such trade tensions often make investors worried and seek gold as a safe haven.

Besides gold prices, spot silver prices fell 0.8% to $40.87 an ounce, despite earlier hitting its highest since 2011. Platinum fell 0.5% to $1,415.03 an ounce and palladium fell 1% to $1,136.26 an ounce.

Gold price forecast

Technically, spot gold has broken through the $3,500/ounce level and is continuing to push higher towards $3,600/ounce. December gold has hit $3,605. The next target is to break and hold above the resistance level at $3,700/ounce.

According to forecasts from JP Morgan experts, gold prices could reach $3,675/Ounce by the end of 2025 and reach $4,250/Ounce by the end of 2026.

If the jobs report on Friday is weaker than expected, the possibility of the Fed cutting rates by 25 basis points in September will further support the gold price, according to Peter Grant, vice president and senior metals strategist at Zaner Metals. He predicts that gold prices will be able to rise even higher, with short- and medium-term targets of $3,600 to $3,800 per ounce, and even $4,000 per ounce by the end of the first quarter of next year.

Michele Schneider, chief market strategist at MarketGauge, said it is difficult to predict how high gold prices can go. Last week, she predicted that gold would soon surpass $3,500 an ounce.

Ms. Schneider commented that the $4,000/ounce level could be within sight, as the gold market is only in the beginning of a strong increase. Technically, the longer the accumulation period, the stronger the subsequent increase.

She believes that a move to $3,800-$4,000 an ounce is highly possible and could be a reasonable target before some investors decide to take profits. Even at that price, the window of opportunity is not closed for those who want to enter the market.

Wellington Letter editor Bert Dohmen also pointed out that there is a shift of money from the stock market to gold. He said that the US stock market is in the most dangerous speculative state of his career and predicted a serious recession, possibly the worst since 1929.

According to Mr. Dohmen, in the initial phase of the financial market downturn, gold and silver may also be sold off because they are used as a source of cash to meet margin calls. However, this is the premise for the second phase, when central banks print more money and investors flock to safe assets like gold and silver.

Based on a 40-year cycle study he conducted in 1980, Mr. Dohmen predicts that gold prices will continue to rise in the long term and peak in 2031. He believes that the world is entering a period of many conflicts, making tangible assets like gold a real safe haven.