Nghe An: Continue to increase resources for policy credit activities

(Baonghean.vn) - Speaking at the conference summarizing 20 years of implementing preferential credit policies for the poor and other policy beneficiaries, Standing Vice Chairman of the Provincial People's Committee Le Hong Vinh requested Party committees and authorities at all levels to continue to increase resources for policy credit and improve the quality of lending activities of the Policy Bank in the area.

On the side of Nghe An province, there were members of the Provincial Party Committee: Le Hong Vinh - Permanent Vice Chairman of the Provincial People's Committee, Head of the Board of Directors of the Provincial Social Policy Bank; Nguyen Nam Dinh - Permanent Vice Chairman of the Provincial People's Council, and representatives of relevant departments and branches.

|

Standing Vice Chairman of the Provincial People's Committee Le Hong Vinh spoke at the conference summarizing 20 years of implementing preferential credit policies for the poor and other policy beneficiaries according to Decree No. 78/2002/ND-CP dated October 4, 2002 of the Government. Photo: Thu Huyen |

Efficiency from preferential capital

Implementing the Party's policy of economic development coupled with sustainable poverty reduction, on October 4, 2002, the Government issued Decree No. 78/2002/ND-CP on credit for the poor and other policy beneficiaries. At the same time, the Prime Minister issued Decision No. 131/2002/QD-TTg on the establishment of the Social Policy Bank, on the basis of reorganizing the Bank for the Poor, separating preferential credit from commercial credit, in order to focus on mobilizing resources from the whole society to invest in the National Target Program on sustainable poverty reduction.

In Nghe An, the Nghe An branch of the Social Policy Bank was established under Decision No. 44/QD-HDQT dated January 14, 2003 of the Chairman of the Board of Directors of the Social Policy Bank and officially opened for operation on April 9, 2003.

|

Delegates attending the summary conference. Photo: Thu Huyen |

After 20 years, policy credit capital in Nghe An has provided capital for 1.3 million poor households and policy beneficiaries to invest in production and improve their lives; thanks to that, 267,800 poor households have overcome the poverty line and have significantly improved their lives; attracted and created stable jobs for 49,000 workers from the national employment fund; 10,300 workers have received loans to work abroad; 100,300 households doing business in difficult areas have capital to invest in production and business; 261,700 households in rural areas have received loans to build over 262,000 clean water works and 261,000 standard sanitation works, improving living conditions and improving the environment in rural areas.

Over 37,200 poor households have been able to borrow capital to build solid houses, stabilize their lives, and eliminate makeshift, dilapidated houses; over 625,000 students in difficult circumstances have been able to borrow capital to study; 18,000 ethnic minority households with special difficulties have been able to borrow capital to create stable livelihoods, etc. Many economic models have been organized for the poor and other policy beneficiaries to participate in, bringing high efficiency.

|

Director of the Provincial Social Policy Bank Tran Khac Hung reported on the results of activities at the conference. Photo: Thu Huyen |

From the first 3 credit programs in operation, Nghe An Social Policy Bank has now deployed 22 credit programs. The 20-year loan turnover reached 32,143 billion VND, with 1,272 thousand poor households and policy beneficiaries receiving loans. The total outstanding debt as of June 30, 2022 reached 10,522 billion VND, an increase of 10,215 billion VND compared to the time of establishment (an increase of 34.31 times), with 279,300 customers still having outstanding debt.

|

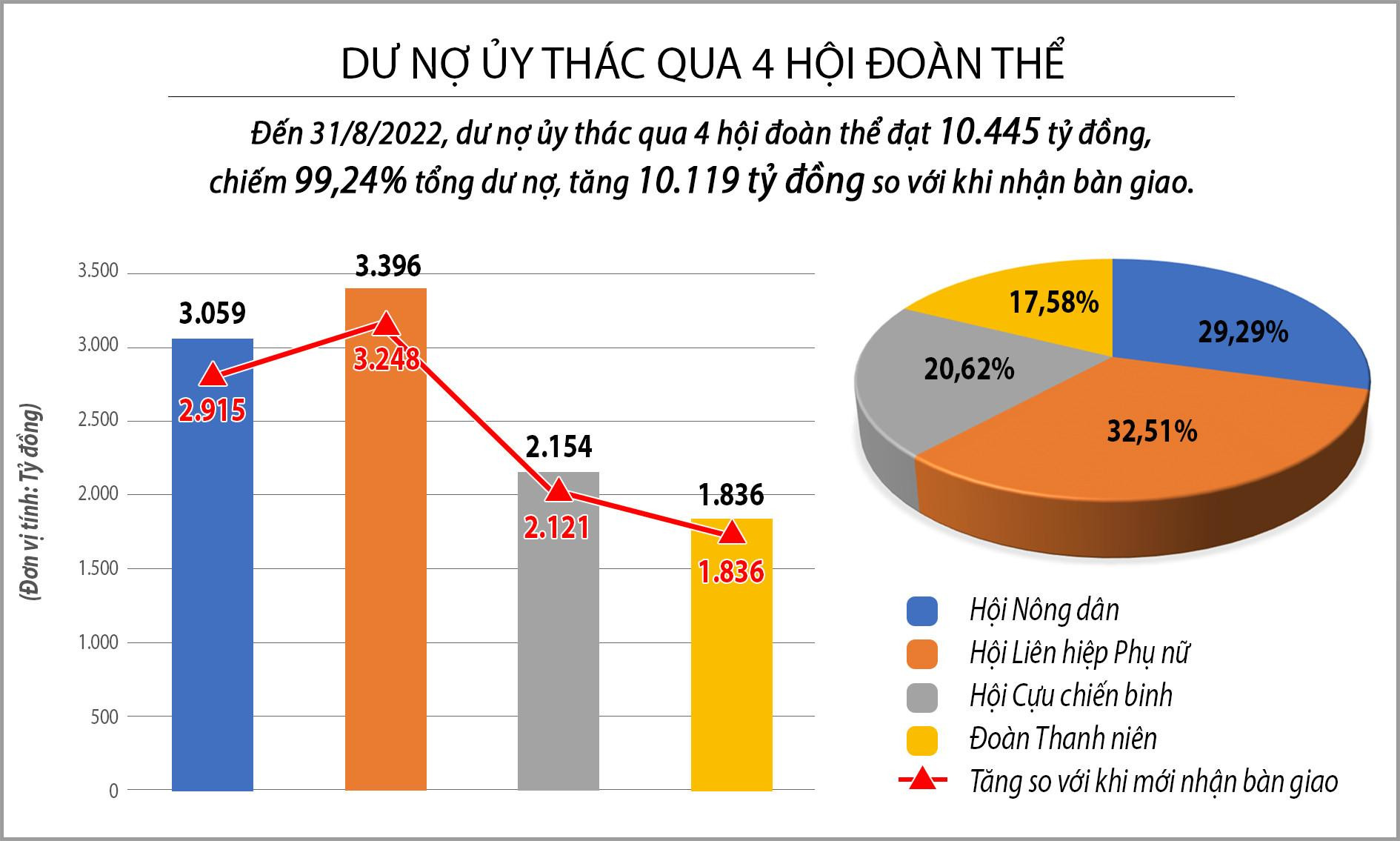

Graphics: Huu Quan |

Of which, the poor household loan program has the highest 20-year loan turnover, reaching 8,232 billion VND, with over 293,400 poor households borrowing capital. Next are the near-poor household loan programs and poverty-escaping households loan programs. Nghe An is also the locality with the largest outstanding debt of the Student Loan Program in the country. Over the past 20 years, the loan turnover has been 4,475 billion VND, with over 250,000 households borrowing capital for 625,000 students to go to school. The outstanding debt as of June 30, 2022 is 295 billion VND, accounting for 2.8% of the total outstanding debt, with 8,400 households borrowing capital.

|

| Many farm economic models in Quy Hop district were built with loans from the Social Policy Bank. Photo: Thu Huyen |

Increasing resources for policy credit

Discussing at the conference, delegates all affirmed the important role of social policy credit in implementing the National Target Program on Sustainable Poverty Reduction, supporting youth start-ups, and developing the socio-economy in ethnic minority areas; at the same time, they proposed that ministries and branches allocate sufficient resources for the Social Policy Bank to effectively implement preferential credit policies and increase loan levels for the programs.

|

| On behalf of the Provincial Party Committee, Mr. Le Hong Vinh - Member of the Provincial Party Committee, Permanent Vice Chairman of the Provincial People's Committee awarded Certificates of Merit of the Provincial People's Committee to 21 collectives with outstanding achievements in policy credit activities. Photo: Thu Huyen |

Speaking at the conclusion of the conference, Standing Vice Chairman of the Provincial People's Committee, Head of the Board of Directors of the Provincial Social Policy Bank Le Hong Vinh praised and highly appreciated the efforts of Party committees, authorities, and organizations at all levels; departments, branches, sectors, political and social organizations at all levels; officers and employees of the Provincial Social Policy Bank for excellently completing their tasks and effectively implementing policy credit in the area. The results in the past 20 years of operation have proven that State resources through policy credit programs have been effective, contributing significantly to the successful implementation of the poverty reduction target and ensuring social security according to the goals set by the Provincial People's Committee.

|

On behalf of the Provincial Party Committee, Mr. Nguyen Nam Dinh - Member of the Provincial Party Committee, Permanent Vice Chairman of the Provincial People's Council, presented Certificates of Merit of the Provincial People's Committee to 19 individuals with outstanding achievements in policy credit activities. Photo: Thu Huyen |

The Provincial Social Policy Bank has continuously built and improved its network, organizational model and capital management methods. In particular, the network of transaction points located at the headquarters of 460 commune-level People's Committees across the province and 6,283 savings and loan groups operating in 100% of villages (hamlets) is a bright spot in the organization of activities, a breakthrough in administrative reform to create the most favorable conditions for the poor to easily access preferential capital sources of the State as well as access and use financial products and services.

Head of the Board of Representatives of the Provincial Social Policy Bank, Le Hong Vinh, also requested that authorities at all levels pay attention to increasing resources for policy credit; adding target groups, including: households with average living standards; households producing and trading products according to value chains associated with economic programs in each stage in communes that have met the standards of new rural areas, advanced new rural areas, and model new rural areas to policy credit programs, because this is a target group with room and large demand for loans.

|

Authorized, Comrade Do Thi Thu Thao - Vice President of Vietnam Women's Union, Member of the Board of Directors of Vietnam Bank for Social Policies awarded Certificates of Merit from ministries and branches to 1 collective and 6 individuals. Photo: Thu Huyen |

It is recommended that the Vietnam Bank for Social Policies annually balance and increase loan capital sources for job creation, job maintenance and expansion so that policy beneficiaries can access more preferential capital sources. Especially loan capital sources according to Resolution 11/NQ-CP dated January 30, 2022 of the Government.

In addition, local Party committees and authorities pay attention to supplementing the capital source entrusted for lending to poor households, near-poor households and other policy subjects. Directing departments, branches and sectors in the province to organize and integrate socio-economic development projects, aiming to create a synchronous impact to help poor households raise awareness of applying scientific advances, grasp market information into the practice of using loans more effectively, helping the poor escape poverty quickly and sustainably.

|

| Comrade Huynh Van Thuan - Deputy General Director of Vietnam Bank for Social Policies awarded the Certificate of Honor from the General Director of Vietnam Bank for Social Policies to 4 individuals who are members of the Board of Representatives of the Bank for Social Policies at all levels who have made many contributions to policy credit activities. Photo: Thu Huyen |

On this occasion, the Provincial People's Committee awarded Certificates of Merit to 21 groups and 19 individuals; the General Director of the Vietnam Bank for Social Policies honored 4 individuals who are members of the Board of Directors of the Vietnam Bank for Social Policies at all levels who have made many contributions to policy credit activities; 1 group and 6 individuals received Certificates of Merit from ministries and branches.

.jpg)