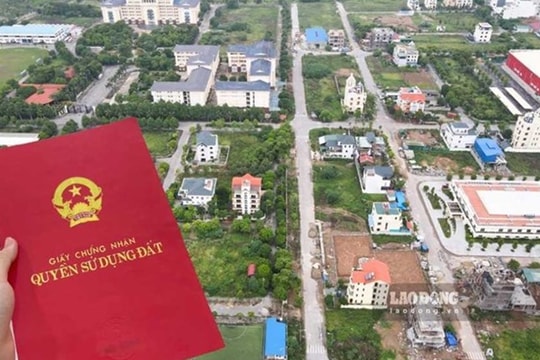

When is land use fee determined in red book issuance procedures according to the latest regulations?

The time used as the basis for determining land use fees in the procedure for requesting a red book is the time of submitting the application for a red book or the time the application is transferred to the tax authority to determine financial obligations?" The issue of concern of Mr. Lam Van Hoang (Do Luong, Nghe An).

Reply:Pursuant to Point a, Point b, Clause 3, Article 155, Land Law 2024, the time for calculating land use fees in the procedure for granting red books (granting Certificates of land use rights and ownership of assets attached to land) is determined as follows:

a) In the case of land use right recognition (issuance of red book for land in stable use without documents), the time for calculating land use fee is the time when the land user, owner of property attached to land or representative of the land user, owner of property attached to land submits complete and valid documents according to the provisions of law.

b) In cases where the State allocates land, leases land, allows change of land use purpose, extends land use, adjusts land use term, or changes land use form, it is the time when the State issues a decision to allocate land, lease land, allow change of land use purpose, extend land use, adjust land use term, or change land use form.

Thus, depending on each case, the time to determine land use fees in the red book issuance procedure will be determined differently:

- In case of red book issuance through land use rights recognition: the time of submission of complete and valid documents.

- In case of granting red book through land allocation or land lease: it is the time of decision by competent state agency.

.jpg)