Market news and commodity prices this afternoon, September 17, 2025

Market news this afternoon, September 17th, at 5:00 PM: Domestic gold prices remain unchanged, the USD exchange rate rises again, causing world gold prices and pepper and coffee prices to fall sharply.

- World gold prices fell slightly this afternoon.

- Domestic gold prices this afternoon, September 17, 2025

- The latest gold price list for this afternoon, September 17, 2025, is as follows:

- USD exchange rate on the afternoon of September 17th: Slightly decreased domestically, but increased again globally.

- Pepper prices today, September 17, 2025: Domestic prices slightly decreased.

- Coffee prices today, September 17, 2025: Sharp decline.

- Oil prices today, September 17, 2025: Cooling down, but geopolitical risks still threaten the market.

World gold prices fell slightly this afternoon.

As of 5:00 PM Vietnam time today, the world gold price has reached $3665.13 per ounce, down 0.82% or $30.5 per ounce compared to yesterday.

Based on today's USD/VND exchange rate at Vietcombank (26,457 VND/USD), the world gold price today is equivalent to 116.9 million VND/ounce. Currently, the domestic gold price is about 15.4 million VND/ounce higher than the world gold price.

Gold priceDomestic news this afternoon, September 17, 2025

As of 5:00 PM today, September 17, 2025, the price of gold bars in Vietnam remains unchanged compared to yesterday. Specifically:

The price of SJC gold bars, as listed by DOJI Group, is 130.3 - 132.3 million VND/ounce (buying price - selling price). At the same time, the price of gold bars listed by Saigon Jewelry Company Limited (SJC) and PNJ is also 130.3 - 132.3 million VND/ounce (buying price - selling price).

Meanwhile, at Mi Hong Gold and Gemstone Company, the price of SJC gold at the time of the survey was listed at 131.3-132.3 million VND/ounce for buying and selling. At Bao Tin Minh Chau Company Limited, the price of gold bars was traded at 130.3 - 132.3 million VND/ounce (buying - selling).

At Phu Quy, the price of SJC gold bars is being traded by businesses at 129.8 - 132.3 million VND/ounce (buy - sell).

As of 5:00 PM on September 17, 2025, the price of 9999 Hung Thinh Vuong gold rings at DOJI remained unchanged at 126.8 - 129.8 million VND/ounce (buying price - selling price).

Bao Tin Minh Chau lists the price of gold rings unchanged at 127.6 - 130.6 million VND/ounce (buying price - selling price).

The latest gold price list for this afternoon, September 17, 2025, is as follows:

| Gold prices this afternoon | September 17, 2025 (Million VND) | Difference (thousand dong/ounce) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 130.3 | 132.3 | But | But |

| DOJI Group | 130.3 | 132.3 | But | But |

| Mi Hong | 131.3 | 132.3 | But | But |

| PNJ | 130.3 | 132.3 | But | But |

| Bao Tin Minh Chau | 130.3 | 132.3 | But | But |

| Phu Quy | 129.8 | 132.3 | But | But |

| 1.DOJI- Updated: September 17, 2025, 17:00 - Website time of the supplier - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 130,300 | 132,300 |

| AVPL/SJC HCM | 130,300 | 132,300 |

| AVPL/SJC DN | 130,300 | 132,300 |

| Ingredients 9999 - HN | 119,500 | 120,500 |

| Ingredients 999 - HN | 119,400 | 120,400 |

| 2.PNJ- Updated: September 17, 2025, 17:00 - Website time of the supplier - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bars | 130,300 | 132,300 |

| PNJ Plain Ring 999.9 | 126,800 | 129,800 |

| 999.9 Gold | 126,800 | 129,800 |

| 999.9 Gold for Fortune, Prosperity and Wealth | 126,800 | 129,800 |

| PNJ Gold - Phoenix | 126,800 | 129,800 |

| 999.9 gold jewelry | 123,900 | 126,400 |

| 999 gold jewelry | 123,770 | 126,270 |

| 9920 gold jewelry | 122,990 | 125,490 |

| 99% Gold Jewelry | 122,740 | 125,240 |

| 916 Gold (22K) | 113,380 | 115,880 |

| 750 Gold (18K) | 87,450 | 94,950 |

| 680 Gold (16.3K) | 78,600 | 86,100 |

| 650 Gold (15.6K) | 74,810 | 82,310 |

| 610 Gold (14.6K) | 69,750 | 77,250 |

| 585 Gold (14K) | 66,590 | 74,090 |

| 416 Gold (10K) | 45,230 | 52,730 |

| 375 Gold (9K) | 40,050 | 47,550 |

| 333 Gold (8K) | 34,360 | 41,860 |

| 3.SJC- Updated: September 17, 2025, 17:00 - Website time (source) - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 130,300 | 132,300 |

| SJC gold, 5 taels | 130,300 | 132,320 |

| SJC gold bars: 0.5 tael, 1 tael, 2 taels | 130,300 | 132,330 |

| SJC 99.99% pure gold rings, 1 tael, 2 taels, 5 taels. | 126,600 | 129,400 |

| SJC 99.99% pure gold rings, 0.5 tael and 0.3 tael. | 126,600 | 129,300 |

| 99.99% Jewelry | 123,800 | 126,800 |

| 99% Jewelry | 120,544 | 125,544 |

| Jewelry 68% | 78,882 | 86,382 |

| Jewelry 41.7% | 45,530 | 53,030 |

USD exchange rate on the afternoon of September 17th: Slightly decreased domestically, but increased again globally.

As of 5:00 PM on September 17th, the State Bank of Vietnam announced the central exchange rate at 25,198 VND/USD, a decrease of 10 dong compared to yesterday.

With a trading range of ±5%, the ceiling exchange rate is 26,457 VND/USD and the floor exchange rate is 23,938 VND/USD.

At the State Bank of Vietnam's exchange floor, the reference exchange rate is listed at 23,989 VND/USD for buying and 26,407 VND/USD for selling.

In the commercial banking market, Vietcombank listed the USD exchange rate at 26,177 - 26,457 VND/USD (buying - selling), a decrease of 11 dong compared to September 16th.

BIDV also adjusted its rates downwards, recording 26,195 - 26,457 VND/USD, a decrease of 7 dong in the buying rate and 11 dong in the selling rate.

The USD exchange rate on the free market reversed course and rose sharply this morning, both for buying and selling, compared to the previous session. In the Hanoi market, the USD traded (buy - sell) at around 26,436 - 26,536 VND/USD, a sharp increase of 59 VND/USD for both buying and selling compared to the previous session.

On the afternoon of September 17th, Hanoi time, the Dollar Index rose 0.17% to 96.81 points. Both the dollar index and futures contracts increased 0.1% in Asian trading, recovering from their lowest levels in two months.

This recovery is occurring amid investor expectations that the US Federal Reserve (Fed) will cut interest rates by at least 25 basis points at its upcoming policy meeting. Some traders even expect a cut of up to 50 basis points, given the signs of a cooling US labor market.

Pepper prices today, September 17, 2025: Domestic prices slightly decreased.

Today's pepper prices in key growing regions have slightly decreased compared to yesterday. As a result, the average domestic pepper price is between 147,000 VND/kg and 150,000 VND/kg.

In the Central Highlands region, today's pepper price in Dak Lak decreased slightly by 1000 VND/kg compared to yesterday, currently standing at 150,000 VND/kg.

Today's pepper price in Gia Lai decreased by 1000 VND/kg compared to yesterday, currently standing at 147,000 VND/kg.

Today's pepper price in Lam Dong (formerly Dak Nong) decreased by 1000 VND/kg compared to yesterday, currently standing at 150,000 VND/kg.

In the Southeast region, today's pepper price in Ho Chi Minh City (formerly Ba Ria - Vung Tau) is 149,000 VND/kg, down 1,000 VND/kg compared to yesterday. Dong Nai also saw a decrease of 1,000 VND/kg compared to yesterday, now at 149,000 VND/kg.

Additionally, today's pepper price in Dong Nai (formerly Binh Phuoc) decreased by 1000 VND/kg compared to yesterday, currently standing at 147,000 VND/kg.

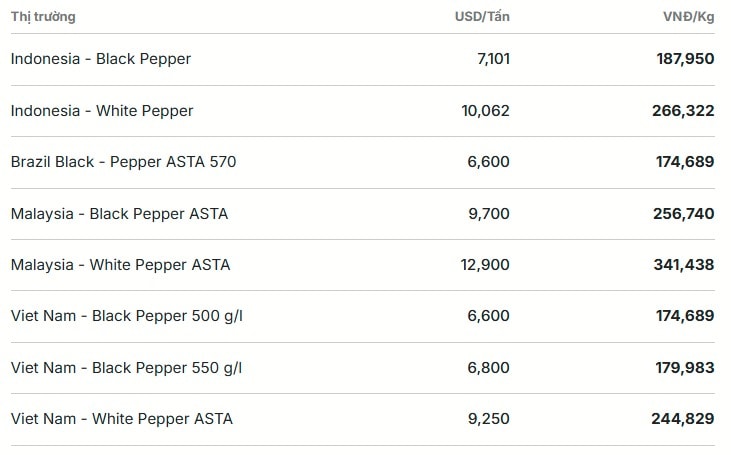

On the world market, based on quotations from exporting companies and export prices in various countries, the International Pepper Association (IPC) has updated the prices of various types of pepper traded on the international market on September 17th (local time) as follows:

Indonesian Lampung black pepper prices remained unchanged from yesterday at US$7,101/tonne. Additionally, Muntok white pepper prices also remained unchanged from yesterday at US$10,062/tonne.

Brazilian ASTA black pepper prices remained unchanged from yesterday at $6,600 per ton.

Malaysian ASTA black pepper prices remained unchanged from yesterday at US$9,700/tonne. Similarly, ASTA white pepper prices also remained unchanged from yesterday at US$12,900/tonne.

Prices for all types of Vietnamese pepper remain unchanged compared to yesterday. Specifically, the price of Vietnamese black pepper (500 gr/l) is 6,600 USD/ton; and the price of 550 gr/l is 6,800 USD/ton.

In addition, the price of Vietnamese white pepper remained unchanged from yesterday at $9,250 per ton.

Coffee prices today, September 17, 2025: Sharp decline.

Domestic coffee prices in the Central Highlands region today, September 15, 2025, have sharply decreased compared to yesterday, fluctuating between 120,000 and 121,500 VND/kg.

Accordingly, traders in the former Dak Nong region are buying coffee at a maximum of 121,500 VND/kg, a sharp decrease of 1,300 VND/kg compared to yesterday.

Similarly, the price of coffee in Dak Lak province is 121,200 VND/kg, a decrease of 1,500 VND/kg compared to yesterday.

Coffee prices in Gia Lai province decreased by 1500 VND/kg compared to yesterday and are trading at 121,000 VND/kg.

In Lam Dong province, the price of coffee decreased by 2200 VND/kg compared to yesterday, reaching 120,000 VND/kg.

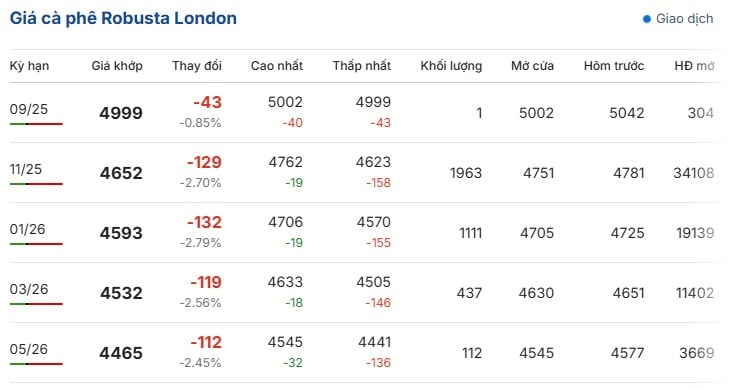

On the London exchange, online robusta coffee futures contracts for September 2025 delivery reached $4999 per ton, down 0.85% ($43 per ton) from yesterday. The November 2025 contract fell 2.7% ($129 per ton) to $4652 per ton.

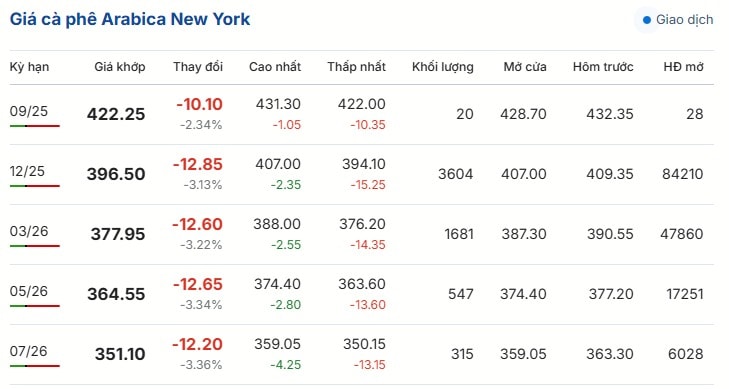

On the New York Stock Exchange, the price of Arabica coffee for September 2025 delivery fell 2.34% (10.1 US cents/pound) compared to yesterday, to 422.25 US cents/pound. The December 2025 contract fell 3.13% (12.85 US cents/pound), reaching 396.5 US cents/pound.

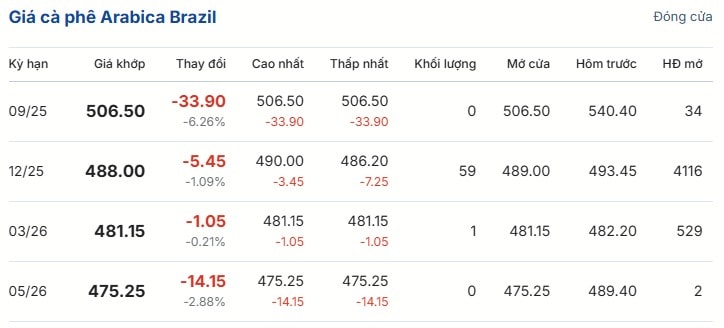

On the Brazilian exchange, the price of Arabica coffee for September 2025 delivery fell 6.28% (33.9 US cents/pound) compared to yesterday, to 506.5 US cents/pound. The December 2025 contract fell 1.09% (5.45 US cents/pound), reaching 488 US cents/pound.

Oil prices today, September 17, 2025: Cooling down, but geopolitical risks still threaten the market.

Oil prices edged lower on September 17th after a more than 1% gain, but geopolitical concerns and expectations of a Fed interest rate cut kept the market high.

Specifically, Brent crude futures for next month fell to $68.14 per barrel, down 0.5% from the previous session. US WTI crude also fell 0.5%, to $64.20 per barrel.

Earlier, both types of oil had risen by more than 1% amid concerns that supplies from Russia could be disrupted following Ukrainian drone attacks.

According to expert John Evans of PVM Oil Associates, if the damage to Russian energy facilities is only short-term, oil prices are likely to return to their familiar range of around $5 per barrel.

Russia is believed to have warned some producers about the possibility of having to cut production after attacks on export infrastructure and refineries. Meanwhile, OPEC+ is increasing supply, making it difficult for oil prices to sustain a strong upward trend in the medium term.

Priyanka Sachdeva, an expert from Phillip Nova, believes the market remains supported by geopolitical risks and potential supply disruptions, especially with winter approaching and fuel demand rising. However, she believes a global supply surplus in 2025 is almost certain, particularly as OPEC+ continues to increase production.

Another factor being closely watched by investors is the Federal Reserve's monetary policy meeting. The market expects the Fed to lower interest rates by 0.25 percentage points. If this prediction is correct, borrowing costs will decrease, potentially boosting fuel demand and supporting oil prices.

Sources from the American Petroleum Institute (API) indicate that U.S. crude oil and gasoline inventories decreased last week, while distillate product inventories increased. Analysts are also awaiting official data from the U.S. Energy Information Administration (EIA). A Reuters survey forecasts a decrease in crude oil inventories and an increase in gasoline and distillate product inventories.